|

| Top ETFs |

Intermediate Term Bond Fund

Intermediate term bond fund should be your primarily choice for income diversification. It has a lower risk than long term bond fund. It also has a higher yield than short term bond fund. You can invest in intermediate-term bond fund through mutual fund, exchange traded fund, or closed end fund.The intermediate term bond fund uses its assets to purchase investment grade corporate bonds, government bonds (U.S. Treasury) or other U.S. fixed income debts. These debts typically have durations of 4 to 7 years. As mentioned before, they are less sensitive to interest rates, therefore less volatile than long duration bonds.

Top Performer ETFs

These top performer ETFs are sorted based on its 1 year return (up to May 2013). You can find the fund review from this article. Other fund information can be found below such as expense ratio, Morningstar rating, fund’s NAV, managers, fund’s holdings, yield, etc.

Best performing intermediate term bond ETFs May 2013 are:

- PIMCO Total Return ETF (BOND)

- Guggenheim BulletShares 2020 Corporate Bond (BSCK)

- iShares Financials Sector Bond (MONY)

- Vanguard Intermediate-Term Corporate Bond Index ETF (VCIT)

- Guggenheim BulletShares 2019 Corp Bond (BSCJ)

- PIMCO Investment Grade Corporate Bond Index ETF (CORP)

- Guggenheim BulletShares 2017 Corporate Bond (BSCH)

- iShares Barclays Credit Bond (CFT)

- Vanguard Intermediate-Term Bond ETF (BIV)

- SPDR Barclays Cap Intermediate Term Corporate Bond (ITR)

- iShares Barclays Intermediate Credit Bond (CIU)

- iShares Barclays CMBS Bond (CMBS)

- Guggenheim BulletShares 2016 Corporate Bond (BSCG)

- Powershares Fundamental Investment Grade Corporate Bond (PFIG)

- iShares Barclays Government/Credit Bond (GBF)

- Columbia Core Bond ETF (GMTB)

- Vanguard Total Bond Market ETF (BND)

- iShares Core Total US Bond Market ETF (AGG)

- Schwab U.S. Aggregate Bond ETF (SCHZ)

- iShares Barclays Intermediate Government/Credit Bond (GVI)

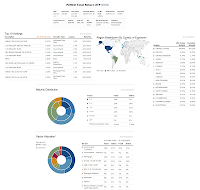

PIMCO Total Return ETF (BOND)

|

| PIMCO ETF details |

Best PIMCO Mutual Funds for 2013

This bond fund is currently traded at 0.07% from its NAV. It invests in a diversified portfolio of high quality bonds. The annual expense ratio is 0.55%. The fund is classified as the Core Fixed Income fund sector. The most recent dividend payment was given in April 2013 in the amount of $0.21.

As part of the best performing intermediate term bond ETFs, it has an effective maturity of 7.54 years. The fund also has an effective duration of 5.09 years. The top 5 holdings as of March 2013 are GNMA I TBA (8.27%), US Treasury Inflate Prot Bond (5.83%), US Treasury Note (3.42%) and Mex Bonos Desarr Fix Rate Bond (3.14%). The top region breakdown is United States with 98.88%.

Guggenheim BulletShares 2020 Corporate Bond (BSCK)

Guggenheim BulletShares 2020 Corporate Bond utilizes its assets to purchase U.S. dollar-denominated investment-grade corporate bonds with effective maturities in the year 2020. The fund’s CUSIP is 18383M514. Its expense ratio is 0.24%. Currently, it has 12-month dividend yield of 2.76%.The top 5 bond holdings are JP Morgan Chase & C0 (2.13%), Kraft Foods Inc (1.68%), Bank of America Corp (1.67%), Morgan Stanley (1.63%) and Anheuser-Busch Inbev Wor (1.49%). The top fund sectors as of March 2013 are Finance (42.11%), Consumer Non-Durables (7.33%), Industrial Services (6.88%) and Consumer Services (6.79%).

iShares Financials Sector Bond ETF (MONY)

|

| iShares fund profile |

As of March 2013, this top performing intermediate term bond ETF has 115 holdings. The top 5 bond in its portfolio are Goldman Sachs Group Inc (2.46%), Morgan Stanley (2.22%), General Electric Capital Corp (2.16%), Citigroup Inc (2.01%) and Merrill Lynch & Co Inc (1.99%). The top ten holdings represent 20.59% of the total fund. Financial Institutions is the top sector with a percentage of 90.50%.

Vanguard Intermediate-Term Corporate Bond Index ETF (VCIT)

Morningstar analysts rank this Vanguard Intermediate-Term Corporate Bond Index ETF with 5-stars rating. As part of the Vanguard fund family, it has total net assets of $3.31 billion. This top ETF invests mainly in high quality corporate bonds. The 12-month dividend yield is 3.15%.8 Best Exchange Traded Funds for 2013

The fund’s benchmarks are Barclays US 5-10 year Corporate Index and Barclays US Aggregate Bond Index. The annual expense ratio is only 0.12%. Joshua C. Barrickman and Paul M. Malloy are the current fund managers.

The top 2 sectors are Industrial (58.0%) and Finance (30.8%). The top holdings as of December 2012 are Merrill Lynch Co (0.54%), Goldman Sachs group (0.48%), JPMorgan Chase (0.47%) and US Treasury Note (0.42%).

Guggenheim BulletShares 2019 Corp Bond ETF (BSCJ)

This Guggenheim BulletShares 2019 Corp Bond ETF has an expense ratio of 0.24%. It is currently traded at 0.40% premium from its NAV. It also has total net assets of $47.73 million. The top holdings of this BSCJ fund are Goldman Sachs Group Inc (2.17%), Pfizer Inc (.02%), Anheuser-Busch Inbev Wor (1.84%) and Citigroup Inc (1.81%). The top sector is Finance (34.44%).PIMCO Investment Grade Corporate Bond Index ETF (CORP)

|

| PIMCO ETF profile |

As one of the best performing intermediate term bond ETFs, the top holdings as of March 2013 are CDX IG19 10Y BP CME (2.81%), REPO (1.59%), GECC Global SR Unsecured (1.33%), HSBC Bank USA (1.27%) and AT&T Global (1.06%). The fund also has 9.94 years of effective maturity and 6.53 years of effective duration.

Best Funds Information

| No | Fund Description | Ticker | Expense Ratio | Yield | Net Assets (mil) |

|---|---|---|---|---|---|

| 1 | PIMCO Total Return ETF | BOND | 0.55% | 2.06% | $5,290.0 |

| 2 | Guggenheim BulletShares 2020 Corp Bond | BSCK | 24.00% | 2.76% | $28.9 |

| 3 | iShares Financials Sector Bond | MONY | 0.30% | 2.88% | $10.7 |

| 4 | Vanguard Interm-Tm Corp Bd Idx ETF | VCIT | 0.12% | 3.15% | $3,310.0 |

| 5 | Guggenheim BulletShares 2019 Corp Bond | BSCJ | 24.00% | 2.37% | $47.7 |

| 6 | PIMCO Investment Grade Corp Bd Index ETF | CORP | 0.20% | 3.32% | $171.0 |

| 7 | Guggenheim BulletShares 2017 Corp Bond | BSCH | 0.24% | 2.35% | $247.2 |

| 8 | iShares Barclays Credit Bond | CFT | 0.20% | 3.39% | $1,360.0 |

| 9 | Vanguard Intermediate-Term Bond ETF | BIV | 0.10% | 2.95% | $4,560.0 |

| 10 | SPDR Barclays Cap Interm Term Corp Bnd | ITR | 15.00% | 2.98% | $407.0 |

| 11 | iShares Barclays Intermediate Credit Bd | CIU | 0.20% | 3.02% | $5,480.0 |

| 12 | iShares Barclays CMBS Bond | CMBS | 0.25% | 2.27% | $62.3 |

| 13 | Guggenheim BulletShares 2016 Corp Bond | BSCG | 0.24% | 2.11% | $214.0 |

| 14 | Powershares Fundamental Inv Gr Corp Bond | PFIG | 0.22% | 2.13% | $31.0 |

| 15 | iShares Barclays Government/Credit Bond | GBF | 0.20% | 2.40% | $190.0 |

| 16 | Columbia Core Bond ETF | GMTB | 0.57% | 2.47% | $5.3 |

| 17 | Vanguard Total Bond Market ETF | BND | 0.10% | 2.50% | $18,160.0 |

| 18 | iShares Core Total US Bond Market ETF | AGG | 0.08% | 2.43% | $15,630.0 |

| 19 | Schwab U.S. Aggregate Bond ETF | SCHZ | 0.05% | 2.05% | $461.0 |

| 20 | iShares Barclays Interm Govt/Credit Bond | GVI | 0.20% | 2.00% | $1,110.0 |

Fund Performance

| No | Fund Description | Ticker | YTD Return % | 1 Year Return % |

|---|---|---|---|---|

| 1 | PIMCO Total Return ETF | BOND | 2.12% | 9.96% |

| 2 | Guggenheim BulletShares 2020 Corp Bond | BSCK | 2.00% | 9.66% |

| 3 | iShares Financials Sector Bond | MONY | 1.05% | 8.61% |

| 4 | Vanguard Interm-Tm Corp Bd Idx ETF | VCIT | 2.18% | 8.26% |

| 5 | Guggenheim BulletShares 2019 Corp Bond | BSCJ | 1.96% | 8.19% |

| 6 | PIMCO Investment Grade Corp Bd Index ETF | CORP | 1.38% | 7.02% |

| 7 | Guggenheim BulletShares 2017 Corp Bond | BSCH | 1.40% | 6.30% |

| 8 | iShares Barclays Credit Bond | CFT | 1.54% | 6.41% |

| 9 | Vanguard Intermediate-Term Bond ETF | BIV | 1.22% | 5.52% |

| 10 | SPDR Barclays Cap Interm Term Corp Bnd | ITR | 1.15% | 5.73% |

| 11 | iShares Barclays Intermediate Credit Bd | CIU | 1.11% | 5.24% |

| 12 | iShares Barclays CMBS Bond | CMBS | 1.42% | 5.87% |

No comments:

Post a Comment