Highest Yield CEFs

|

| Highest Yield CEFs |

These closed end funds list is selected based on its high yield for the past 1 year. The yield may include only pure dividend or mixed between dividend and return of assets (ROA). For details about the closed end fund screener, you can find the below table. Some of these top highest yield CEFs are among the best closed end funds.

From this article, you can also find the each closed end fund research below. The fund families include Cornerstone Advisors Inc, RiverSource Investments LLC, Gabelli Funds Inc, PIMCO, Allianz Global Investors Fund Management LLC, Wells Fargo Funds Management, and others.

The top 25 highest yield closed end funds 2013 are:

- Cornerstone Strategic Value (CLM)

- Cornerstone Total Return (CRF)

- Cornerstone Progressive Return (CFP)

- Oxford Lane Capital Corp (OXLC)

- Columbia Seligman Premium Technology (STK)

- GAMCO Global Gold Natural Resource & Income (GGN)

- AGIC Convertible & Income II (NCZ)

- PIMCO High Income Fund (PHK)

- Cushing MLP Total Return Fund (SRV)

- AGIC Convertible & Income (NCV)

- AGIC Intl & Premium Strategy (NAI)

- GAMCO Nat Res Gold & Income (GNT)

- ING Global Equity Dividend & Prem Opportunities (IGD)

- GDL Fund (GDL)

- Wells Fargo Advantage Global Dividend Opportunities (EOD)

- NFJ Dividend Interest & Premium (NFJ)

- Dividend and Income Fund (DNI)

- Guggenheim Enhanced Equity Income (GPM)

- ING Risk Management Natural Resources (IRR)

- EV Tax-Managed Global Fund (EXG)

- EV Tax-Managed Global B-W Opportunities (ETW)

- Guggenheim Enhanced Eq. Strategy (GGE)

- ING Emerging Market High Dividend (IHD)

- Aberdeen Chile Fund (CH)

- Cohen & Steers Global Income Builder (INB)

High Dividend Fund

Cornerstone Strategic Value fund (CLM)

Cornerstone Strategic Value fund utilizes its assets to invest in global equity securities. This top high yield closed end fund has total net assets of $105.8 million. It has been in the market since 1987. The expense ratio is 1.47% per year. The 12-month dividend yield is 17.37%. The market price is trading 24.43% premium to NAV (net asset value). The most recent distribution will be given on April 30, 2013 in the amount of $0.1022.Best High Yield Closed End Funds for 2013 and 2014

This top stock fund has 160 total holdings as of December 2012. The top 4 holdings are Fidelity Institutional MM Fds Government I (18.28%), Eaton Vance Tax-Managed Global Diversified Equity Income (3.79%), BlackRock Global Opportunities Equity (3.76%) and Apple Inc (3.48%).

Oxford Lane Capital Corp fund (OXLC)

Oxford Lane Capital Corp fund is currently traded at -7.93% from its NAV. The fund’s objective is to maximize its portfolios total return. It has total net assets of $84.98 million. The fund is in the Taxable Income-Senior Loan category. The annual expense ratio is rather high at 6.15% per year. The distribution rate is 13.72%.

Columbia Seligman Premium Technology fund (STK)

|

| STK fund details |

As one of the highest yield CEFs, it has $227.9 million of total net assets. It also has annual expense ratio of 1.15%. The quarterly-distributed dividend is 12.85%. The recent distribution was done in February 2013 in the amount of $0.4625. The CUSIP of this fund is 19842X109.

As of March 2013, the top holdings of this fund are Synopsys (9.51%), Symantec (7.28%), Apple (5.93%), Nuance Communications (5.46%), Lam Research Corp (5.21%), KLA-Tencor Corp (4.59%), Qualcomm (4.30%), Check Point Software Technologies (4.22%), Google (3.87%) and NetApp (3.56%).

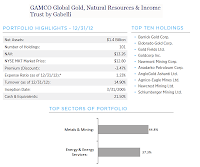

GAMCO Global Gold Natural Resource & Income fund (GGN)

|

| GGN fund |

The highest yield closed end fund uses its assets to buy equity securities issued by gold and natural resources industries. Its expense ratio is 1.31%. This equity energy fund is currently traded at -1.79% from its NAV.

As of fourth quarter of 2012, the fund had a total of 101 holdings. The top holdings are Barrick Gold Corp, Eldorado Gold Corp, Gold Fields Ltd, Goldcorp Inc, Newmont Mining Corp, Anadarko Petroleum Corp, AngloGold Ashanti Ltd, Agnico-Eagle Mines Ltd, Newcrest Mining Ltd and Schlumberger Mining Ltd.

AGIC Convertible & Income fund II (NCZ)

The investment objective of Allianzgi Convertible & Income Fund II is to provide total return through capital growth and high current income. Douglas Forsyth and Justin Kass are the current fund managers. The fund’s CUSIP. It trades 7.13% premium to its current NAV. The distribution rate is 11.99%. This yield is distributed on monthly basis. It also has annual expense ratio of 1.31%.

More: Best Closed End Funds 2012 & 2013

This top multi sector closed end fund has returned 10.44% over the past 3 year, and 8.06% over the past 5 year. The effective leverage is 36.70%. The fund has total net assets of $806.5 million as of April 18, 2013.

The top holdings of this NCZ fund as of March 2013 are Felcor Lodging Trust Inc (1.65%), Bank of America Corp (1.58%), Vector Group Ltd (1.43%), Swift Mand Comm Exchange Security (1.40%) and Continental Finance Trust II (1.39%). The top 3 convertible sectors are Financials (28.52%), Consumer Discretionary (13.51%) and Industrials (11.62%).

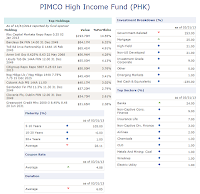

PIMCO High Income Fund (PHK)

|

| PIMCO fund details |

This high yield fund has returned 9.23% over the past 1 year, 13.39% over the past 3 year, and 14.62% over the past 5 year. The fund manager is the bond guru, Bill Gross.

The fund has average duration of 6.85 years and average maturity is 28.11 years. The top sectors of this fund as of March 2013 are Banks (24.0%), Non-Captive Cons. Finance (9.0%) and Insurance Life (7.0%).

Disclosure: No Position

CEF Fund Information

| No | Fund Name | Ticker | Strategy | Yield | Premium / Discount | Market Cap | Expense Ratio |

|---|---|---|---|---|---|---|---|

| 1 | Cornerstone Strategic Value | CLM | US Equity-General Equity | 17.37% | 22.77 | $105.8 | 1.37% |

| 2 | Cornerstone Total Return | CRF | US Equity-General Equity | 17.46% | 20.85 | $51.9 | 1.98% |

| 3 | Cornerstone Progressive Return | CFP | US Equity-General Equity | 17.00% | 28.3 | $117.3 | 1.33% |

| 4 | Oxford Lane Capital Corp | OXLC | Taxable Income-Senior Loan | 13.72% | -7.93 | $85.0 | 6.15% |

| 5 | Columbia Seligman Premium Tech | STK | US Equity-Covered Call | 12.85% | -3.49 | $227.9 | 1.15% |

| 6 | GAMCO Glb Gold Natural Res&Inc | GGN | US Equity-Energy/Resources | 13.82% | -1.79 | $1,010.8 | 1.31% |

| 7 | AGIC Convertible & Income II | NCZ | Taxable Income-Multi-Sector | 11.99% | 6.31 | $806.5 | 1.31% |

| 8 | PIMCO High Income Fund | PHK | Taxable Income-High Yield | 11.85% | 41.19 | $1,367.7 | 1.16% |

| 9 | Cushing MLP Total Return Fund | SRV | US Equity-MLP | 11.49% | 8.3 | $277.4 | 3.73% |

| 10 | AGIC Convertible & Income | NCV | Taxable Income-Multi-Sector | 11.56% | 5.9 | $1,052.0 | 1.29% |

| 11 | AGIC Intl & Premium Strategy | NAI | US Equity-Covered Call | 11.35% | -5.65 | $102.6 | 1.32% |

| 12 | GAMCO Nat Res Gold & Income | GNT | US Equity-Covered Call | 12.70% | -1.13 | $239.6 | 1.17% |

| 13 | ING Glb Eqty Div & Prem Opps | IGD | US Equity-Covered Call | 11.03% | -6.06 | $949.2 | 1.24% |

| 14 | GDL Fund | GDL | Non-US/Other-Global Equity | 11.04% | -11.8 | $420.6 | 4.58% |

| 15 | Wells Fargo Adv Glo Div Opp | EOD | Non-US/Other-Global Equity Dividend | 10.94% | -5.65 | $400.2 | 1.07% |

| 16 | NFJ Div Interest & Premium | NFJ | US Equity-Covered Call | 11.02% | -6.15 | $1,644.7 | 0.97% |

| 17 | Dividend and Income Fund | DNI | US Equity-Growth & Income | 10.55% | -9.37 | $124.6 | 2.99% |

| 18 | Guggenheim Enhanced Equity Inc | GPM | US Equity-Covered Call | 10.87% | -4.33 | $237.9 | 1.86% |

| 19 | ING Risk Mgt Natural Resources | IRR | US Equity-Covered Call | 10.88% | -7.21 | $252.5 | 1.22% |

| 20 | EV Tax-Managed Global Fund | EXG | US Equity-Covered Call | 10.51% | -10.16 | $3,155.2 | 1.05% |

| 21 | EV Tax-Managed Glb B-W Opps | ETW | US Equity-Covered Call | 10.45% | -9.7 | $1,317.5 | 1.08% |

| 22 | Guggenheim Enhanced Eq. Strtgy | GGE | US Equity-Growth & Income | 10.49% | -4.44 | $120.2 | 1.93% |

| 23 | ING Emerging Market High Div. | IHD | Non-US/Other-Emerging Market Equity | 10.20% | 5.45 | $257.8 | 1.18% |

| 24 | Aberdeen Chile Fund | CH | Non-US/Other-Latin American Equity | 10.78% | -0.5 | $136.6 | 1.70% |

| 25 | Cohen & Steers Glb Inc Builder | INB | US Equity-Covered Call | 10.19% | -4.43 | $334.7 | 1.90% |

No comments:

Post a Comment