Top Mutual Funds by Nuveen Investments

Top Mutual Funds by Nuveen Investments

Nuveen Investments provides financial products such as mutual funds, closed end funds, separately managed accounts, commodity exchange traded products (ETPs), and defined portfolio. Known for its top closed end funds, it also provides high rank stock and bond mutual funds. It offers different style of mutual funds. You can find municipal bond fund, taxable fixed income fund, global and international fund, value fund, asset allocations, index fund and more.In 2013, they have 15 mutual funds rated as best fund by Lipper fund awards. Some of the top funds are Nuveen High Yield Municipal Bond fund, Nuveen All-American Municipal Bond fund.

Best Funds

These best mutual funds are sorted based on its performance, fees and quality for future return. You can find various funds to invest in such as bond mutual fund, and stock mutual fund. Please check the fund prospectus for investment risk, fund details, etc.The best Nuveen mutual funds are:

- Nuveen Real Estate Securities (FREAX)

- Nuveen Limited Term Municipal Bond (FLTDX)

- Nuveen All-American Municipal Bond (FLAAX)

- Nuveen Santa Barbara Dividend Growth (NSBAX)

- Nuveen Dividend Value (FFEIX)

- Nuveen Strategic Income (FCDDX)

- Nuveen Ohio Municipal Bond (FOHTX)

- Nuveen Tradewinds Value Opportunities (NVOAX)

- Nuveen Global Infrastructure (FGIAX)

- Nuveen Missouri Municipal Bond (FMOTX)

- Nuveen High Yield Municipal Bond (NHMAX)

- Nuveen Intermediate Duration Municipal Bond (NMBAX)

Typically the Class A funds have sales load. You can invest in Class R3 or Class R6 or Class I for no load funds. These no load Franklin Templeton mutual funds are available through retirement account (IRA) or 401(k) account or other regular brokerage account.

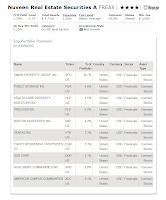

Nuveen Real Estate Securities Fund (FREAX)

Nuveen Real Estate Securities Fund (FREAX)

This Nuveen Real Estate Securities fund aim is to achieve above average current income and long-term capital appreciation. It invests mainly in U.S. equity real estate investment trusts (REITs). The fund managers are John Wenker, Jay Rosenberg and Scott Sedlak. Its net assets are totaling $4.7 billion. The annual expense ratio is 1.26%. It also has a dividend yield of 1.79%.More: Best Performing Real Estate Mutual Funds of 2012

Ranked with 4-stars and Bronze rating by Morningstar, this best mutual fund has 6.75% YTD return as of July 2013. Its best 1-year total return was achieved in 2006 with 39.13%. Based on the load adjusted returns, it has returned 15.52% over the past 3-year and 11.64% over the past decade.

As of June 2013, the top 5 stocks in its holdings are Simon Property Group Inc (10.7%), Public Storage Inc (5.6%), Health Care Property Investors Inc (4.5%), Prologis Inc (4.2%) and Boston Properties (4.2%).

Nuveen Limited Term Municipal Bond fund (FLTDX)

Paul L. Brennan manages this Nuveen Limited Term Municipal Bond fund since 2006. It utilizes its assets to purchase a portfolio of municipal bonds that pay interest that is exempt from regular federal personal income tax. It has total net assets of $3.7 billion. Its 12-month trailing yield is 2.10%. The most recent distribution was given in May 2013 in the amount of $0.02. It also has low annual expense ratio of 0.66%.This best mutual fund in Muni National Short category has 4-stars rating from Morningstar. Its 3-year beta risk is only 0.50. Since the inception in 1987, this bond fund has recorded 23 years of positive return and only 2 years of negative return. The fund has returned 0.35% over the past 1-year and 3.47% over the past 5-year. The fund also has average effective maturity of 4.72 years and effective duration of 3.68 years.

The top portfolio holdings as of June 2013 are Univ of Texas Fing System Revenue (0.6%), Illinois St (0.6%), Washington St Var Purp (0.6%), Golden St Tobacco Settlement (0.6%) and Penn EDFA Unemployment Comp (0.6%).

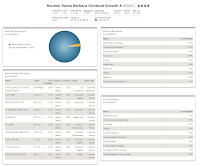

Nuveen Santa Barbara Dividend Growth Fund (NSBAX)

This Nuveen Santa Barbara Dividend Growth fund is one of the best mutual funds in Large Blend category. It focuses on equity securities of mid- to large-capitalization companies. These companies have the potential for dividend income and dividend growth. The fund distributes 1.92% yield. The average annual holdings turnover is 26.00% as of June 2013. It has total net assets of $2.1 billion.

This Nuveen Santa Barbara Dividend Growth fund is one of the best mutual funds in Large Blend category. It focuses on equity securities of mid- to large-capitalization companies. These companies have the potential for dividend income and dividend growth. The fund distributes 1.92% yield. The average annual holdings turnover is 26.00% as of June 2013. It has total net assets of $2.1 billion.The other classes of this fund are Class C (NSBCX), Class R3 (NBDRX) and Institutional Class (NSBRX). The Class A fund has 4-stars rating from Morningstar. You can buy this Nuveen mutual fund with $3,000 minimum initial funding. You can purchase from brokerages such as JPMorgan, Vanguard, Firstrade, etc.

This equity mutual fund has its best 1-year total return of 17.17%. It had only 1 year of negative return so far. It was occurred in 2008 with -24.61%. The fund has a 5-year average return of 5.94%.

The top 5 holdings are Cash Equivalent (3.9%), CVS Corp (3.1%), Wells Fargo & Co (3.1%), JP Morgan Chase & Co (3.1%), Pfizer Inc (3.1%), VF Corp (3.0%) and Time Warner Cable Inc (3.0%).

Nuveen Dividend Value Fund (FFEIX)

Managed by Cori Johnson and Derek Sadowsky, this Nuveen Dividend Value fund has an expense ratio of 1.16%. The fund’s CUSIP is 670678887. The current shares price is $16.81 (as of July 9, 2013). The fund has total net assets of $1.6 billion. Its 12b1 fee is 0.25% and front-end sales load fee is 5.75%.More: Top Mutual Funds by Vanguard Group

Based on the load adjusted returns, this best mutual fund has returned 16.09% over the past 3-year and 7.38% over the past 5-year. Its best 1-year total return was achieved in 2003 with 26.30%. The fund is ranked with 4-stars rating by Morningstar.

Based on the load adjusted returns, this best mutual fund has returned 16.09% over the past 3-year and 7.38% over the past 5-year. Its best 1-year total return was achieved in 2003 with 26.30%. The fund is ranked with 4-stars rating by Morningstar.The top 3 sector allocations are Financials (26.5%), Health Care (12.3%) and Energy (12.1%). The top portfolio holdings are Pfizer Inc (4.0%), General Electric Company (3.7%), Citigroup Inc (3.0%), Bank of America Corp (2.8%) and Chevron Corp (2.8%).

Nuveen High Yield Municipal Bond Fund (NHMAX)

This Nuveen High Yield Municipal Bond fund was first introduced to public in June 1999. Its objective is to seek high current income exempt from regular federal income taxes. The secondary objective is capital appreciation. Popular with investors, it has large assets of $7.8 billion. It also has high 12-month dividend yield of 6.24%. Its expense ratio is 0.83% per year.This NHMAX fund is rated with 3-stars rating and Neutral rating. This muni bond fund has YTD return of -4.63% as of July 2013. The worst 1-year total return was in 2008 was recorded in 2008 with -40.45% and the best in 2009 with 42.34%. The fund uses Lipper High Yield Municipal Debt Fund as its benchmark.

The fund has effective maturity of 21.39 years and effective duration of 12.02 years. California (16.5%) and Florida (11.4%) are the top states in this fund. The top holdings are Iowa Finance Authority Alcoa Inc (1.0%), Tennessee Energy Acq Corp Gas Rev (0.9%), Buckeye Tobacco SFA Asset Backed (0.7%), Dallas-FT Worth International Airport American (0.7%) and Dallas FT Worth Arpt American Airlines (0.7%).

Nuveen Intermediate Duration Municipal Bond (NMBAX)

This Nuveen Intermediate Duration Municipal Bond fund is one of the best mutual funds in the Muni National Intermediate category. It is currently managed by Paul L. Brennan. The fund is seeking for high level of current interest income exempt from regular federal income taxes and the capital preservation. The total net assets are $3.8 billion. The fund has annual expense ratio of 0.72%. The average ratio in the category is 0.82%.More: Best Mutual Funds 2014

As one of the best Nuveen mutual funds, it has 3-stars rating from Morningstar. It has YTD return of -2.91%. The minimum initial investment for this fund is $3,000. The fund has returned 5.79% in 2012 and 7.82% in 2011. Based on the load adjusted returns, the fund has returned 3.88% over the past 10-year.

The top sector allocations are Tax Obligation/ Limited (27.2%), Tax Obligation/ General (20.7%) and Health Care (15.4%). The top states are Texas (8.3%) and Illinois (8.3%). The top portfolio holdings are Citizens Property Ins Corp High Risk (0.9%), New Jersey Transn Trust (0.9%), Buckeye Tobacco SFA Asset Backed (0.8%), Massachusetts St (0.8%) and New Mexico Fin Auth Transn Rev SR LN (0.8%).

Fund Information

| No | Fund Description | Ticker | Category | Rating | Assets (mil) |

|---|---|---|---|---|---|

| 1 | Real Estate Securities | FREAX | Real Estate | 4 | $4,600 |

| 2 | Limited Term Municipal Bond | FLTDX | Muni National Short | 4 | $3,700 |

| 3 | All-American Municipal Bond | FLAAX | Muni National Long | 4 | $2,700 |

| 4 | Santa Barbara Dividend Growth | NSBAX | Large Blend | 4 | $2,100 |

| 5 | Dividend Value | FFEIX | Large Value | 4 | $1,600 |

| 6 | Strategic Income | FCDDX | Intermediate-Term Bond | 4 | $626 |

| 7 | Ohio Municipal Bond | FOHTX | Muni Ohio | 4 | $580 |

| 8 | Tradewinds Value Opportunities | NVOAX | World Stock | 4 | $568 |

| 9 | Global Infrastructure | FGIAX | World Stock | 4 | $557 |

| 10 | Missouri Municipal Bond | FMOTX | Muni Single State Long | 4 | $451 |

| 11 | California High Yield Municipal Bond | NCHAX | Muni California Long | 4 | $305 |

| 12 | Massachusetts Municipal Bond | NMAAX | Muni Massachusetts | 4 | $265 |

| 13 | Minnesota Municipal Bond | FJMNX | Muni Minnesota | 4 | $234 |

| 14 | Kansas Municipal Bond | FKSTX | Muni Single State Long | 4 | $226 |

| 15 | High Yield Municipal Bond | NHMAX | High Yield Muni | 3 | $7,800 |

| 16 | Intermediate Duration Municipal Bond | NMBAX | Muni National Interm | 3 | $3,800 |

| 17 | Mid Cap Growth Opportunities | FRSLX | Mid-Cap Growth | 3 | $1,200 |

| 18 | Short Term Bond | FALTX | Short-Term Bond | 3 | $905 |

| 19 | Equity Index | FAEIX | Large Blend | 3 | $762 |

| 20 | New York Municipal Bond | NNYAX | Muni New York Long | 3 | $743 |

Top Fund Returns

| No | Fund Description | Ticker | YTD Return % | 1-Year Return % | 3-Year Return % | 5-Year Return % | 10-Year Return % |

|---|---|---|---|---|---|---|---|

| 1 | Real Estate Securities | FREAX | 6.75% | 8.33% | 17.27% | 10.05% | 12.11% |

| 2 | Limited Term Municipal Bond | FLTDX | -1.33% | -0.20% | 2.53% | 3.49% | 3.12% |

| 3 | All-American Municipal Bond | FLAAX | -4.89% | -1.07% | 5.53% | 5.83% | 4.72% |

| 4 | Santa Barbara Dividend Growth | NSBAX | 12.09% | 19.92% | 16.72% | 7.75% | N/A |

| 5 | Dividend Value | FFEIX | 17.81% | 26.54% | 17.77% | 9.83% | 8.10% |

| 6 | Strategic Income | FCDDX | -1.62% | 5.59% | 6.64% | 7.89% | 5.80% |

| 7 | Ohio Municipal Bond | FOHTX | -4.29% | -0.89% | 4.18% | 4.68% | 4.05% |

| 8 | Tradewinds Value Opportunities | NVOAX | 13.48% | 24.90% | 9.76% | 8.31% | N/A |

| 9 | Global Infrastructure | FGIAX | 4.81% | 15.05% | 12.61% | 5.37% | N/A |

| 10 | Missouri Municipal Bond | FMOTX | -3.52% | -0.69% | 4.71% | 5.06% | 4.26% |

No comments:

Post a Comment