Top Retirement Mutual Funds

Top Retirement Mutual Funds

The target date 2016-2020 mutual fund utilizes its assets to purchase a portfolio of bonds, stocks, and short term cash. It is suitable for investors who have the years 2016-2020 date for retirement or other goal. The mutual fund will adjust its risk and return based on this target date. Over time, the fund will become more conservative as the target date approaches.You may find the individual fund review from this best mutual funds list. Check the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on fees, yield, fund returns, and potential for growth.

Best target date 2016-2020 mutual funds are:

- Vanguard Target Retirement 2020 Fund (VTWNX)

- T. Rowe Price Retirement 2020 Fund (TRRBX)

- TIAA-CREF Lifecycle Index 2020 Fund (TLWIX)

- Schwab Target 2020 Fund (SWCRX)

- American Funds Target Date Retirement 2020 Fund (AACTX)

- TIAA-CREF Lifecycle 2020 Retirement Fund (TCLTX)

- Vantagepoint Milestone 2020 Fund (VPROX)

- JPMorgan SmartRetirement 2020 Fund (JTTAX)

- American Century Asset Allocation Portfolios One ChoiceSM 2020 Portfolio (ARBMX)

- MFS Lifetime 2020 Fund (MFLAX)

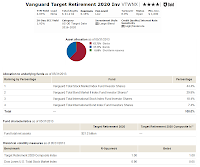

Vanguard Target Retirement 2020 Fund (VTWNX)

Vanguard Target Retirement 2020 Fund fund has total net assets of $21.2 billion. The fund’s objective is to offer a diversified portfolio within a single fund that adjusts its underlying asset mix over time. The fund has low annual expense ratio of 0.16%. The dividend yield is 2.03%. The fund managers are Michael H. Buek, William Coleman and Walter Nejman.Morningstar analysts rank this best target date 2016-2020 mutual fund with 4-stars and Gold rating. Based on the load adjusted returns, the fund has returned 9.41% over the past 1-year and 5.18% over the past 5-year. Since 2006, the fund has its best total return in 2009 with 23.10%. The only year it returned in negative return was in 2008 with -27.04%.

Target Retirement 2020 Composite Index and Dow Jones U.S. Total Stock Market Index are the benchmarks of this Vanguard fund. The top asset allocations are Stocks (62.75%) and Bonds (37.17%).

T. Rowe Price Retirement 2020 Fund (TRRBX)

T. Rowe Price Retirement 2020 Fund uses its assets to purchase a diversified portfolio of other T. Rowe Price stock and bond funds. The objective of this TRRBX fund is to provide the highest total return over time. It is opened to new retail investors. The fund has annual expense ratio of 0.70%. The average expense ratio in the category is 0.54%. The yield is 1.85% with the recent distribution in December 2012 ($0.35).The benchmarks are Lipper Mixed-Asset Target 2020 Funds Average and Custom Benchmark-Retirement 2020 Fund Broad Index. As part of best target date 2016 - 2020 mutual funds, its average annual total returns since its inception is 8.83%. Morningstar analysts rank this balanced fund with 4-stars and Gold rating. Based on the load adjusted returns, the fund has returned 10.82% over the past 3-year and 8.94% over the past 10-year.

As of May 2013, the top 5 funds in its holdings are Emerging Markets Stock Fund, Equity Index 500 Fund, Growth Stock Fund, High Yield Fund and Inflation Focused Bond Fund. The top ten holdings represent 83.51% of the total net assets. The top asset allocation is Domestic Stock (47.6%), Domestic Bond (21.4%) and Foreign Stock (20.8%).

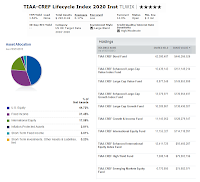

TIAA-CREF Lifecycle Index 2020 Fund (TLWIX)

Hans Erickson, John Cunniff and Pablo Mitchell are the current portfolio managers of this TIAA-CREF Lifecycle Index 2020 Fund. They managed this fund to seek for high total return over time through a combination of capital appreciation and income. The fund has a dividend yield of 1.63%. The fund’s CUSIP is 886315647. The total net assets are $292.8 million. Its annual expense ratio is quite low, only 0.17%.

Hans Erickson, John Cunniff and Pablo Mitchell are the current portfolio managers of this TIAA-CREF Lifecycle Index 2020 Fund. They managed this fund to seek for high total return over time through a combination of capital appreciation and income. The fund has a dividend yield of 1.63%. The fund’s CUSIP is 886315647. The total net assets are $292.8 million. Its annual expense ratio is quite low, only 0.17%.This fund of fund uses Large Blend investment style. It has 5-stars rating from Morningstar. The fund has returned 8.65% over the past 1-year and 9.86% over the past 3-year. The fund uses Lifecycle 2020 Fund Composite Index as the benchmark. The yearly return of this TLWIX fund since the inception is as below:

- Year 2012: 12.28%

- Year 2011: 1.53%

- Year 2010: 11.97%

Best Mutual Funds Information

| No | Fund Description | Ticker | Rating | Expense Ratio | Yield | Net Assets (mil) | Min to Invest |

|---|---|---|---|---|---|---|---|

| 1 | Vanguard Target Retirement 2020 Inv | VTWNX | 4 | 0.16% | 2.03% | $21,200 | $1,000 |

| 2 | T. Rowe Price Retirement 2020 | TRRBX | 4 | 0.70% | 1.85% | $18,200 | $2,500 |

| 3 | TIAA-CREF Lifecycle Index 2020 Inst | TLWIX | 5 | 0.17% | 1.63% | $293 | $ 2 mil |

| 4 | Schwab Target 2020 | SWCRX | 5 | 0.67% | 2.08% | $377 | $100 |

| 5 | American Funds Trgt Date Ret 2020 A | AACTX | 2 | 0.74% | 1.94% | $2,800 | $250 |

| 6 | TIAA-CREF Lifecycle 2020 Retire | TCLTX | 3 | 0.69% | 2.07% | $1,800 | $- |

| 7 | Vantagepoint Milestone 2020 Inv M | VPROX | 4 | 0.84% | 1.75% | $561 | $- |

| 8 | JPMorgan SmartRetirement® 2020 A | JTTAX | 3 | 0.94% | 2.40% | $2,600 | $500 |

| 9 | American Century One Choice 2020 A | ARBMX | 3 | 1.08% | 1.54% | $921 | $2,500 |

| 10 | MFS Lifetime 2020 A | MFLAX | 3 | 0.98% | 1.88% | $285 | $1,000 |

Fund Returns

| No | Fund Description | Ticker | YTD Return | 1-Year Return % | 3-Year Return % | 5-Year Return % | 10-Year Return % |

|---|---|---|---|---|---|---|---|

| 1 | Vanguard Target Retirement 2020 Inv | VTWNX | 5.50% | 11.53% | 11.79% | 5.82% | - |

| 2 | T. Rowe Price Retirement 2020 | TRRBX | 5.70% | 13.24% | 12.96% | 6.34% | 7.48% |

| 3 | TIAA-CREF Lifecycle Index 2020 Inst | TLWIX | 5.46% | 11.21% | 11.89% | - | - |

| 4 | Schwab Target 2020 | SWCRX | 5.69% | 11.84% | 12.01% | 5.99% | - |

| 5 | American Funds Trgt Date Ret 2020 A | AACTX | 6.69% | 13.04% | 11.96% | 5.10% | - |

| 6 | TIAA-CREF Lifecycle 2020 Retire | TCLTX | 4.97% | 12.14% | 12.03% | 5.33% | - |

| 7 | Vantagepoint Milestone 2020 Inv M | VPROX | 6.40% | 12.04% | 11.07% | 5.09% | - |

| 8 | JPMorgan SmartRetirement® 2020 A | JTTAX | 4.26% | 11.21% | 11.64% | 6.40% | - |

| 9 | American Century One Choice 2020 A | ARBMX | 4.46% | 9.33% | 10.74% | 5.47% | - |

| 10 | MFS Lifetime 2020 A | MFLAX | 3.73% | 9.94% | 11.09% | 5.34% | - |

No comments:

Post a Comment