World Bond Funds

World Bond Funds

World bond mutual fund utilizes its assets to purchase high quality non-US bonds and U.S. debts. It may invest in foreign government or corporate debts of developed countries including U.S. Some world bond funds may invest in lower quality bonds from developed or emerging markets.These top performing mutual funds are sorted based on its 1 year return (up to July 2013). You can find the fund review from this article. Other fund information can be found below such as fund return, expense fee, Morningstar rating, fund’s NAV, managers, fund’s holdings, yield, etc.

Top Mutual Funds

Best performing world bond mutual funds July 2013 are:- Chou Income fund (CHOIX)

- Templeton Global Total Return fund (TGTRX)

- Templeton Global Bond fund (TPINX)

- GMO Currency Hedged International Bond fund (GMHBX)

- Great-West Templeton Global Bond Initial Fund (MXGBX)

- Matthews Asia Strategic Income fund (MAINX)

- Templeton International Bond fund (TBOAX)

- PIMCO Foreign Bond (USD-Hedged) fund (PFOAX)

- Dreyfus Global Dynamic Bond fund (DGDAX)

- BlackRock World Income fund (MDWIX)

- Legg Mason BW International Opportunities Bond MDWIX (LWOAX)

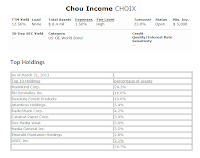

Chou Income Fund (CHOIX)

This Chou Income fund’s objective is to achieve capital appreciation and income production. It invests in money market funds, U.S. treasury, and equity securities. The total net assets are $8.4 million. It has annual expense ratio of 1.50%. This world bond fund also has high yield of 12.56%.As of July 12, 2013, this best performing mutual fund in world bond category has 19.46% of YTD return. Since the fund was just introduced to public in 2010, it has no Morningstar rating yet. The fund has returned -13.84% in 2011 and 34.53% in 2012. The fund is currently managed by Francis S. M. Chou.

The top holdings as of first quarter of 2013 are MannKind Corp (24.3%), RH Donnelley Inc (16.0%), Resolute Forest Products (10.6%), Atlanticus Holdings (5.4%) and RadioShack Corp (4.2%).

Templeton Global Total Return Fund (TGTRX)

Managed by Michael Hasenstab and Sonal Desai, Templeton Global Total Return Fund uses its assets to purchase fixed and floating rate debt securities and debt obligations (including convertible bonds) of governments, government-related or corporate issuers worldwide. Its assets are allocated across fixed income markets around the world. This fixed income fund has total net assets of $7.0 billion. The annual expense ratio is 1.04%. The 12-month trailing yield is 6.59%.Best Bond Funds

Ranked with 5-stars and Silver rating from Morningstar, this top world bond mutual fund has returned 6.83% over the past 1-year and 8.87% over the past 3-year (based on the load adjusted returns). The yearly performance/ return since the inception is as below:- Year 2012: 19.03%

- Year 2011: -1.08% (lowest)

- Year 2010: 14.94%

- Year 2009: 23.90% (highest)

Great-West Templeton Global Bond Initial Fund (MXGBX)

The Great-West Templeton Global Bond Initial Fund has $310.4 million of total net assets. It invests mainly in bonds issued by governments and government agencies located around the world. This top performing world bond mutual fund is ranked with 5-stars rating by Morningstar. It also has 5.06% dividend yield. The annual expense ratio is 1.30%. The fund is currently managed by Michael Hasenstab.This international bond fund has YTD return of -1.58%. Since the inception in 1999, it has recorded 12 years of positive return. The best 1 year total return was achieved in 2006 with 14.85%. So far, it has only one negative return in 2011 with -1.63%.

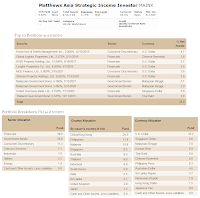

Matthews Asia Strategic Income Fund (MAINX)

As one of the best performing World Bond mutual funds, this Matthews Asia Strategic Income Fund has a high yield of 4.62%. The fund’s CUSIP is 577-125-503. Its expense ratio fee is only 1.17% per year. The total net assets are $50.2 million. The portfolio managers are Teresa Kong, Gerald M. Hwang and Robert J. Horrocks.

As one of the best performing World Bond mutual funds, this Matthews Asia Strategic Income Fund has a high yield of 4.62%. The fund’s CUSIP is 577-125-503. Its expense ratio fee is only 1.17% per year. The total net assets are $50.2 million. The portfolio managers are Teresa Kong, Gerald M. Hwang and Robert J. Horrocks.Based on the load adjusted returns, this top performing mutual fund has returned 9.88% over the past 1-year. The fund has just been incepted to public in 2011. It retuned 13.62% in 2012. The benchmarks of this fund are HSBC Asian Local Bond Index and JP Morgan Asia Credit Index. The portfolio turnover is 18.45%.

As of June 2013, the top 6 positions are Home Inns & Hotel Management Inc (4.7%), Global Logistic Properties Ltd (3.8%), KWG Property Holding Ltd (3.7%), Longfor Properties Co Ltd (3.6%), MCE Finance Ltd (3.6%) and Shimao Property Holdings Ltd (3.5%). The top sector allocations are Financials (39.8%) and Government Bonds (30.6%).

PIMCO Foreign Bond (USD-Hedged) Fund (PFOAX)

This PIMCO Foreign Bond (USD-Hedged) Fund is traded at $10.57 as of July 12, 2013. The objective of this fund is to seek maximum total return, consistent with preservation of capital and prudent investment management. It is ranked with 4-stars and Silver rating by Morningstar. This fixed income fund also has $5.8 billion of total net assets. Its expense ratio is 0.90%.JP Morgan GBI Global ex-US Index Hedged and Lipper International Income Funds Average are the benchmarks. The best 1-year total return within 14 years of positive returns was occurred in 2009 with 18.48%. The only year it has negative returns was in 2008 with -2.84%. The 3-year beta risk is 0.94. The top 3 countries are Japan (40.30%), Germany (26.50%) and United Kingdom (18.70%).

Fund Performance

| No | Fund Description | Ticker | Yield | YTD Return % | 1-Year Return % | 3-Year Return % | 5-Year Return % |

|---|---|---|---|---|---|---|---|

| 1 | Chou Income | CHOIX | 12.56% | 19.46% | 45.10% | 17.96% | N/A |

| 2 | Templeton Global Total Return A | TGTRX | 6.59% | -0.26% | 10.66% | 8.41% | N/A |

| 3 | Templeton Global Bond A | TPINX | 5.44% | -0.94% | 740.00% | 6.25% | 9.31% |

| 4 | GMO Currency Hedged Intl Bond III | GMHBX | 4.31% | -0.09% | 6.04% | 7.00% | 6.82% |

| 5 | Great-West Templeton Global Bond Init | MXGBX | 5.06% | -1.58% | 5.86% | 5.75% | 7.16% |

| 6 | Matthews Asia Strategic Income Investor | MAINX | 4.62% | -2.85% | 5.03% | N/A | N/A |

| 7 | Templeton International Bond A | TBOAX | 4.89% | -2.46% | 4.84% | 5.38% | 8.23% |

| 8 | PIMCO Foreign Bond (USD-Hedged) A | PFOAX | 3.80% | -1.10% | 4.40% | 5.73% | 7.70% |

| 9 | Dreyfus Global Dynamic Bond A | DGDAX | 4.13% | -0.34% | 4.28% | N/A | N/A |

| 10 | BlackRock World Income Inv A | MDWIX | 2.74% | -0.85% | 4.23% | 3.46% | 3.56% |

| 11 | Legg Mason BW International Opps Bd A | LWOAX | 4.33% | -4.36% | 3.66% | 6.11% | N/A |

No comments:

Post a Comment