Top Emerging Markets Stock Funds

Top Emerging Markets Stock Funds

These emerging markets stock CEFs utilizes its assets to purchase a companies located in emerging markets countries. The companies are located in Brazil, China, Russia, Taiwan, India, Mexico, Malaysia, Indonesia, Thailand, etc. Closed end funds are traded like stocks and ETFs (Exchange Traded Funds). They may provide opportunity for growth, value and income.These best performing closed end funds are sorted based on its 1 year total return up to July 15, 2013. You may find other fund review information: expense ratio, fund’s NAV, management, objective, yield, premium/discount, top holdings, etc.

The best performing emerging markets CEFs July 2013 are:

- Mexico Fund (MXF)

- Mexico Equity & Income (MXE)

- Herzfeld Caribbean Basin (CUBA)

- Turkish Investment Fund (TKF)

- Morgan Stanley Eastern Europe (RNE)

- Aberdeen Emerging Markets Smaller Company Opportunities (ETF)

- India Fund (IFN)

- Morgan Stanley Emerging Markets (MSF)

- Central Euro Russia & Turkey (CEE)

- First Trust/Aberdeen Emerging Op (FEO)

- Aberdeen Latin America (LAQ)

- Templeton Emerging Markets (EMF)

- ING Emerging Markets High Dividend Equity (IHD)

- Morgan Stan India Investment (IIF)

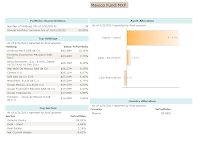

Mexico Fund (MXF)

Mexico Fund (MXF)

This Mexico Fund seeks for long-term capital appreciation. It uses its assets to purchase equity securities listed on the Mexican Stock Exchange. The fund’s managers are Jose Luiz Pimienta and Carlos Woodworth. The current yield is 10.01%. The yield is distributed quarterly. This fund is currently trading 3.50% premium to its NAV. It has total assets of $397.41 million.As one of the best performing emerging markets CEFs, its YTD return as of July 2013 is 8.31%. It has returned 20.35% since the inception in 1981. The top 5 stocks in its holdings are America Movil SAB de CV (10.18%), Fomento Economico Mexicano SAB (7.75%), Bbva Bancomer (6.19%), Wal-Mart De Mexico (6.08%) and Cemex SA (6.07%).

Turkish Investment Fund (TKF)

As its name suggests, this Turkish Investment fund seeks long term capital appreciation through investment in equity securities of Turkish companies. Its expense ratio is 1.20% per year. The fund is currently traded at -13.07% to its NAV. The fund’s sponsor is Morgan Stanley Investment Management Inc.This top emerging markets fund has 1-year annualized return of 18.19% and 10-year annualized return of 19.17%. The YTD return is -4.51%. The top sector is General Equity (98.03%). As of March 2013, the fund’s top holdings are Turkiye Garanti Bankasi AS (19.00%), Anadolu Efes Brewery ve Malt Sanayi (10.03%), Tupras-Turkiye Petrol Rafineleri (9.12%), Turkiye Halk Bankasi AS (8.64%) and Haci Omer Sabanci Holding (8.03%).

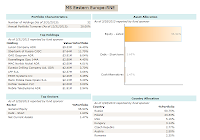

Morgan Stanley Eastern Europe (RNE)

This Morgan Stanley Eastern Europe fund is managed by Eric Carlson and Narayan Ramachandran. This Morgan Stanley fund’s is investing majority of assets in Eastern Europe and Russia-based companies. The fund has effective leverage of 1.34%. Its annual expense ratio is 2.29%. It was first introduced to public in 1996. The dividend yield is 2.04%.

This Morgan Stanley Eastern Europe fund is managed by Eric Carlson and Narayan Ramachandran. This Morgan Stanley fund’s is investing majority of assets in Eastern Europe and Russia-based companies. The fund has effective leverage of 1.34%. Its annual expense ratio is 2.29%. It was first introduced to public in 1996. The dividend yield is 2.04%.The top performing emerging markets stock fund returned 27.62% in 2012 and 21.09% in 2010. It has annualized total returns of 9.54% since its inception. The top 2 country allocations as of March 2013 are Russia (60.75%) and Poland (23.33%). The top 3 stocks are Lukoil Company ADR (14.40%), Sberbank of Russia OJSC (11.79%) and OAO Gazprom ADR (6.04%).

Aberdeen Emerging Markets Smaller Company Opportunities (ETF)

As one of the best performing emerging markets CEFs, it is managed by Neil Gregson. This Aberdeen closed-end fund has total net assets of $180.93 million. Its expense ratio is 1.47% per year. The current share price as of July 1, 2013 is $19.90. It has 3-year annualized return of 9.85% and 10-year annualized total return of 13.66%.As of May 2013, this Aberdeen Emerging Markets Smaller Company Opportunities fund has a total of 86 holdings. The top 5 holdings are Jaya Jusco Stores Berhad (3.38%), Central North Airport Group (2.98%), Eurocash SA (2.52%), Cimsa Cimento Sanayi Ve Ticaret (2.40%) and Spar Group Limited (2.32%). Consumer Staples (21.80%) and Financials (19.70%) are the top 2 sectors.

Closed End Funds Information

| No | Fund Description (Ticker) | 1 Year Return % | Premium / Discount | Expense Ratio % | Yield % |

|---|---|---|---|---|---|

| 1 | Mexico Fund (MXF) | 38.82% | 3.50% | 1.49% | 8.06% |

| 2 | Mexico Equity & Income (MXE) | 37.52% | -9.26% | 1.57% | 1.18% |

| 3 | Herzfeld Caribbean Basin (CUBA) | 26.75% | -8.30% | 2.57% | 2.21% |

| 4 | Turkish Investment Fund (TKF) | 18.19% | -13.07% | 1.18% | 1.27% |

| 5 | Morgan Stanley East Europe (RNE) | 15.77% | -10.51% | 2.37% | 0.27% |

| 6 | Aberdeen EM SmCo Opptys (ETF) | 12.37% | -9.30% | 1.43% | 2.04% |

| 7 | India Fund (IFN) | 9.76% | -14.65% | 1.16% | 11.29% |

| 8 | Morgan Stanley Emerging Markets (MSF) | 7.20% | -11.21% | 1.57% | 0.53% |

| 9 | Central Euro Russia & Tu (CEE) | 6.31% | -10.07% | 1.19% | 3.47% |

| 10 | First Tr/Abrdn Emerg Op (FEO) | 6.25% | -10.89% | 1.78% | 6.65% |

| 11 | Aberdeen Latin America (LAQ) | 6.03% | -9.22% | 1.16% | 4.57% |

| 12 | Templeton Emerging Mkts (EMF) | 5.38% | -9.37% | 1.36% | 2.39% |

| 13 | ING Em Mkts Hi Div Eqty (IHD) | 5.11% | 6.84% | 1.44% | 9.89% |

| 14 | Morg Stan India Inv (IIF) | 4.76% | -14.53% | 1.40% | 0.00% |

| 15 | Templeton Russia & E Eur (TRF) | 4.63% | -10.24% | 1.57% | 1.59% |

| 16 | Templeton Dragon Fund (TDF) | 3.80% | -12.51% | 1.31% | 5.47% |

| 17 | Latin American Discovery (LDF) | 2.50% | -8.73% | 1.53% | 3.00% |

| 18 | Aberdeen Chile (CH) | -2.43% | 4.23% | 1.75% | 10.47% |

No comments:

Post a Comment